I. Executive Summary

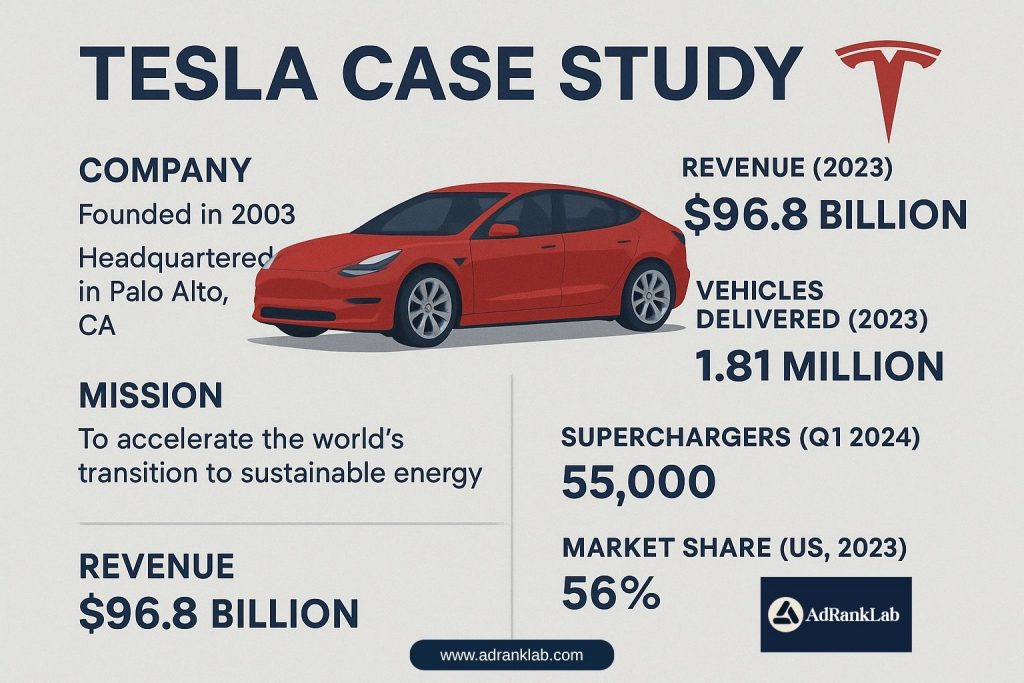

Tesla, Inc. has undergone a transformative journey from its inception in 2003 as a niche electric sports car manufacturer to its current standing as a global pioneer in sustainable energy and advanced technological innovation. Driven by a foundational mission to accelerate the world’s transition to sustainable energy, the company has strategically evolved its product line, disrupted traditional automotive marketing and sales models, and pushed the boundaries of battery technology, artificial intelligence, and manufacturing processes. Exclusive Tesla Case Study by AdRankLab.

This report provides a detailed, fact-based examination of Tesla’s trajectory, encompassing its origins, significant product introductions, unique market engagement strategies, financial performance, and extensive global expansion. It also addresses the various controversies and competitive pressures encountered along the way, while highlighting Tesla’s unwavering commitment to sustainability and its ambitious future vision centered on autonomous vehicles and robotics. The company’s distinctive approach, particularly its reliance on product excellence and the prominent role of its CEO in public relations, has been a critical factor in its remarkable growth and market position.

II. Company Founding and Early Vision (2003-2008)

Founders and Initial Mission

Tesla Motors was formally established in July 2003 by engineers Martin Eberhard and Marc Tarpenning. Their initial objective was to produce high-performance electric vehicles (EVs) that could rival traditional gasoline-powered cars in terms of speed, design, and overall appeal, thereby challenging the prevailing perception of EVs as slow or golf-cart-like alternatives. The company’s name itself pays homage to Nikola Tesla, the 19th-century inventor renowned for his contributions to electrical engineering.

Elon Musk’s involvement began in February 2004 when he led the Series A investment round, contributing $6.5 million of the $7.5 million raised. This substantial investment made him the largest shareholder and secured his position as chairman of the board. The overarching mission, articulated since Tesla’s inception, has consistently been “to accelerate the world’s transition to sustainable energy,” a vision that extends beyond just electric vehicles to encompass energy generation and storage solutions. A 2009 legal settlement later officially recognized other early employees, including Ian Wright and J.B. Straubel, as co-founders alongside Eberhard, Tarpenning, and Musk, reflecting the collaborative efforts in the company’s formative years.

Early Funding Rounds and Key Investors

The Series A financing round in 2004, spearheaded by Elon Musk, provided the critical initial capital for the nascent company. Musk’s continued financial commitment was vital, with his personal investments eventually exceeding $70 million. This capital was essential for a venture as capital-intensive as automotive manufacturing, particularly for a new EV company navigating significant technological and regulatory hurdles.

A pivotal moment for Tesla’s early financial stability occurred in May 2008 when German multinational Daimler AG invested $50 million, acquiring a 10% stake. This investment was later acknowledged by Elon Musk as instrumental in saving Tesla during a critical financial period.

Development and Launch of the Original Roadster

The development of the Tesla Roadster spanned from 2004 through 2007, with initial “development mule” vehicles based on Lotus Elises chassis used for testing the electric drivetrain. The prototypes were publicly unveiled on July 19, 2006. Regular series production of the Roadster officially commenced on March 17, 2008.

The Roadster, Tesla’s inaugural product, was a high-end sports car designed to demonstrate the potential for EVs to be both environmentally conscious and high-performance. It showcased impressive capabilities, including a 0-60 mph acceleration in a mere 3.6 seconds and a range of 300 miles, powered by lithium-ion cells. Initial deliveries were slow, with 27 cars delivered by September 10, 2008, and the 100th car delivered by December 9, 2008. Production of the Roadster ceased in January 2012, with over 2,418 units sold worldwide through September 2012. The Roadster’s primary impact was in establishing Tesla’s brand credibility and proving the viability of electric sports cars, thereby laying the groundwork for more mainstream models.

The Roadster’s development and market introduction were not without challenges. In May 2009, Tesla issued a safety recall for 345 Roadsters manufactured before April 22, 2009, to address an issue with rear, inner hub flange bolts, a problem that originated on the Lotus assembly line. Despite these early hurdles, Tesla achieved its first profit in July 2009, shipping 109 vehicles, a record for a single month at that time. By January 2010, the 1,000th Roadster had been produced, with deliveries reaching customers in 43 states and 21 countries.

Controversies in Founding Narrative

The early years of Tesla were marked by internal conflicts, particularly between Martin Eberhard and Elon Musk, concerning the company’s direction, spending, and management. These tensions culminated in Eberhard’s removal as CEO in August 2007, and by early 2008, both Eberhard and Tarpenning had departed from Tesla. Elon Musk subsequently assumed the role of CEO in October 2008, a position he has maintained since.

In 2009, Eberhard initiated a lawsuit against Tesla and Musk, primarily contending that Musk was misrepresenting himself as the sole founder. The out-of-court settlement reached in September 2009 resulted in Tesla legally recognizing five individuals as co-founders: Martin Eberhard, Marc Tarpenning, Ian Wright, J.B. Straubel, and Elon Musk. Despite this legal resolution, Musk actively cultivated and reinforced his identity as Tesla’s visionary leader through extensive public appearances, interviews, and company statements. His “Top Secret Tesla Motors Master Plan” blog post in 2006, which outlined Tesla’s long-term strategy, played a significant role in positioning him as the primary architect of the company’s direction, even though many core ideas predated his full involvement.

The evolution of Tesla’s founding narrative highlights the profound influence of a dominant figure in shaping a company’s public identity. Musk’s substantial financial investment and his assertive public relations strategy were instrumental in elevating his status as a co-founder and the public face of Tesla, even though the initial technical and business foundation was laid by others. This deliberate cultivation of a strong personal brand, deeply intertwined with the company’s identity, proved critical in attracting further investment and public attention during Tesla’s formative years. This approach established a precedent for Tesla’s future marketing, relying heavily on Musk’s public persona rather than traditional advertising.

The Roadster’s role as a strategic “proof of concept” rather than a mass-market product is also evident in these early years. The Roadster was a high-end sports car with limited production numbers (2,418 units worldwide by September 2012) and a premium price point. It was explicitly slated for discontinuation to be replaced by a new model. This demonstrates that Tesla’s initial strategy was not immediate mass-market adoption, but rather to prove the viability and desirability of high-performance EVs. The Roadster’s success in demonstrating that “EVs could be carbon conscious and cool” was critical. This proof of concept, despite low volume, attracted crucial investment, such as Daimler’s $50 million, and built significant credibility, paving the way for future, more mass-market models like the Model S and Model 3, as outlined in Musk’s “Master Plan”. This “top-down” market entry strategy, starting with high-end models before moving to mass-market offerings, became a hallmark of Tesla’s product evolution. It allowed Tesla to establish a premium brand image and generate substantial public interest before tackling the complexities of high-volume production and affordability, which would later define its significant growth.

Table: Tesla Roadster Production and Delivery Milestones (2008-2012). (Exclusive Tesla Case Study by AdRankLab)

| Milestone | Date | Quantity/Details | Source |

| Regular Production Commences | March 17, 2008 | Goal: 100 vehicles/month | AdRankLab Research |

| Deliveries by September 2008 | September 10, 2008 | 27 cars delivered | AdRankLab Research |

| 100th Car Delivered | December 9, 2008 | 100 cars delivered | AdRankLab Research |

| 1,000th Roadster Produced | January 13, 2010 | 1,000 units produced | AdRankLab Research |

| Production Halted | January 2012 | Production ended | AdRankLab Research |

| Total Units Sold Worldwide | September 2012 | >2,418 units | AdRankLab Research |

This table visually represents the nascent production capabilities and the limited market penetration of Tesla’s first product. It underscores the “proof of concept” nature of the Roadster, rather than a volume play. It provides concrete data points for the early operational phase, highlighting the slow ramp-up typical of a startup in a novel industry, and implicitly demonstrates the critical need for subsequent capital infusions and strategic shifts towards mass production.

III. Product Evolution and Key Milestones

Tesla’s product strategy has consistently involved introducing high-performance, technologically advanced vehicles across various segments, gradually expanding from luxury sports cars to more accessible mass-market offerings and commercial vehicles.

Roadster (2008-2012): Development, Production, and Impact

The original Roadster, launched in 2008, served as Tesla’s inaugural production vehicle, effectively demonstrating the viability and desirability of electric cars as high-performance alternatives. Its production concluded in January 2012, with over 2,418 units sold globally. The Roadster’s primary contribution was in establishing Tesla’s brand identity and proving the feasibility of electric sports cars, thereby laying the groundwork for subsequent, more mainstream models.

Model S (2012), Model X (2015), Model 3 (2017), Model Y (2020)

Following the Roadster, Tesla introduced a series of vehicles that broadened its market appeal and solidified its position in the automotive industry:

- Model S (2012): The Model S sedan, introduced in 2012, marked Tesla’s entry into the luxury sedan market. It quickly garnered significant critical acclaim, earning titles such as Consumer Reports’ “Best Overall Car” and Motor Trend’s “Ultimate Car of the Year”.

- Model X (2015): The Model X SUV, launched in 2015, featured distinctive “falcon-wing doors” and incorporated advanced safety features. It achieved a notable milestone as the first SUV to earn 5-star safety ratings in every category and sub-category from the National Highway Traffic Safety Administration (NHTSA).

- Model 3 (2017): Unveiled in 2017, the Model 3 represented a strategic pivot towards the mass market, offering a more affordable electric vehicle option with a substantial range of over 320 miles. Its sales strategy, heavily reliant on pre-orders and a direct sales model, facilitated a rapid production ramp-up, quickly establishing it as one of the world’s best-selling electric cars.

- Model Y (2020): The Model Y compact SUV began customer deliveries in early 2020. This crossover model effectively combined the practicality of an SUV with Tesla’s efficient electric powertrain, significantly broadening the company’s appeal to a wider consumer base. In 2023, the Model Y achieved the distinction of being the world’s best-selling vehicle across all fuel types, and together with the Model 3, it accounted for an overwhelming 95% of Tesla’s total vehicle deliveries.

Introduction of Cybertruck, Semi, and Next-Gen Roadster

Tesla has continued to expand its product offerings into new segments:

- Tesla Semi (2017): An electric commercial truck, the Semi was unveiled in 2017, promising substantial fuel cost savings for owners, estimated at least $200,000 over a million miles. However, its launch experienced delays, with limited production materializing by early 2023.

- Cybertruck (2019): This futuristic, stainless-steel pickup truck was unveiled in 2019, designed to offer superior utility compared to traditional trucks and enhanced performance akin to a sports car. Production ramped up at Gigafactory Texas, with initial deliveries commencing in 2024. The Cybertruck’s unveiling was notable for a viral moment where its “armor glass” shattered during a live demonstration, an incident that paradoxically boosted its hype and pre-orders.

- Next-Gen Roadster (Unveiled 2017, Production 2025/2026): The second-generation Roadster was surprisingly unveiled in November 2017. It is expected to enter production and go on sale in late 2025 or 2026, promising extreme performance with over 1,020 hp, 1,050 lb-ft of torque, and a top speed exceeding 250 mph.

Overview of Energy Storage Products: Powerwall, Powerpack, Megapack

Beyond vehicles, Tesla has developed a robust energy division, offering scalable battery storage solutions:

- Powerwall: Introduced on April 30, 2015, the Powerwall is a home energy storage system designed to store solar energy for residential use, provide backup power, and reduce reliance on the grid. Pilot units were installed in 2015, with mass production of cells for Powerwalls beginning in January 2017 at Gigafactory Nevada.

- Powerpack (Discontinued): A commercial-scale battery storage product, the Powerpack was used for larger installations, such as utility-scale projects like the Hornsdale Power Reserve, before the introduction of the Megapack.

- Megapack: Launched in July 2019, the Megapack is Tesla’s utility-scale energy storage product, capable of storing up to 3.9 megawatt-hours (MWh) of electricity per unit. Designed for electric utilities, Megapacks are used to replace or augment peaker power plants, provide ancillary services, and facilitate time-shifting of intermittent renewable energy sources like wind and solar. Tesla’s energy deployment significantly increased, reaching 14.7 GWh in 2023 and 31.4 GWh in 2024. A new “Megafactory” in Shanghai, dedicated to Megapack manufacturing, began low-rate initial production in late 2024, with a goal of producing about 10,000 packs per year. This expansion into energy storage highlights Tesla’s strategic evolution beyond merely automotive manufacturing into a comprehensive energy solutions provider.

IV. Technological Innovations

Tesla’s rapid ascent in the automotive and energy sectors is fundamentally rooted in its continuous commitment to technological innovation across multiple domains, from battery chemistry to advanced manufacturing and artificial intelligence.

Battery Technology Evolution

Tesla’s battery strategy has evolved significantly, moving towards larger and more energy-dense cells to achieve greater range and lower costs. Initially, the company utilized 18650 lithium-ion cells in models like the Model S and X. Subsequently, it transitioned to 2170 cells for the Model 3 and Y, which offered increased capacity.

A major advancement was the unveiling of the 4680 cylindrical battery cell, previewed at Tesla’s Battery Day event. Panasonic, a key partner, debuted a prototype of this cell, which is designed to store five times as much energy and cost 50% less to build than the 2170 cells. Tesla projects a 100-fold increase in battery production by 2030 due to this new battery type, which also produces six times the power of current cells. The 4680 refers to the battery’s dimensions: 46 millimeters wide by 80 millimeters tall. Tesla is one of the few automakers using cylindrical cells, and the larger size of the 4680 cell (5.5 times larger than 2170 cells and 8.0 times larger than 18650 cells by volume) contributes to its increased energy capacity. Panasonic operates a battery manufacturing plant in Nevada, supplying the Tesla Gigafactory.

Gigafactory Production Process Innovations

Tesla’s manufacturing philosophy, championed by Elon Musk, emphasizes the “machine that builds the machine,” aiming to automate and optimize the production process to unprecedented levels, minimizing human involvement and maximizing output speed. This approach involves building a production system from scratch rather than merely iterating existing processes, a strategy that carries inherent risks but promises substantial long-term gains in efficiency and scalability.

A key innovation in this regard is the Gigacasting process. This technique utilizes large aluminum castings for significant sections of the car, replacing numerous smaller parts traditionally used in vehicle construction. Tesla’s ambition is to extend this approach to cast the entire underbody of its electric vehicles as a single piece, moving away from the traditional assembly of 400 separate components. This aligns with Elon Musk’s “unboxed” manufacturing strategy, which also incorporates 3D printing to further streamline production and reduce costs. For instance, Gigafactory Texas employs Gigapress machines to produce electric vehicles more efficiently, with an ambitious goal of producing one EV every 45 seconds.

The strategic choice to revolutionize the production process itself, rather than just the product, is a critical element of Tesla’s long-term competitive advantage. By focusing on the efficiency of the manufacturing system, Tesla seeks to achieve economies of scale and cost reductions that are difficult for traditional automakers to replicate, given their entrenched legacy production methods. This emphasis on manufacturing innovation is intended to be as disruptive as the vehicles themselves, allowing Tesla to rapidly scale production and reduce costs per vehicle.

Autopilot and Full Self-Driving (FSD) Development and Levels

Tesla’s advanced driver-assistance systems, Autopilot and Full Self-Driving (FSD), represent a core technological focus. Autopilot includes features such as Traffic-Aware Cruise Control, which matches vehicle speed to surrounding traffic, and Autosteer, which assists in steering within clearly marked lanes. These functionalities are classified as Level 2 self-driving systems, meaning the vehicle can control steering and speed simultaneously, but require continuous driver supervision and hands on the steering wheel.

Full Self-Driving (Supervised) aims to enable the vehicle to drive itself almost anywhere with minimal driver intervention, with continuous improvements delivered through over-the-air (OTA) software updates. FSD capabilities include Navigate on Autopilot (guiding the vehicle from highway on-ramp to off-ramp), Auto Lane Change, Autopark, and Summon features. Tesla’s approach to autonomy relies primarily on a camera-only system, differentiating it from competitors that often integrate lidar or radar. Full autonomy, as defined by Tesla, is contingent on achieving reliability far exceeding human drivers, demonstrated by billions of miles of experience, and requires regulatory approval, which may vary by jurisdiction.

AI and Robotics (Dojo Supercomputer, Optimus, Robotaxi/Cybercab)

Tesla’s long-term vision extends significantly into artificial intelligence and robotics, aiming to create a future where autonomous systems and humanoid robots perform a wide range of tasks.

- Dojo Supercomputer: Tesla developed and built the Dojo supercomputer specifically for computer vision video processing and recognition. Its primary purpose is to train Tesla’s machine learning models, enhancing the Full Self-Driving (FSD) advanced driver-assistance system. Dojo went into production in July 2023. It is designed for scalability, de-emphasizing mechanisms found in typical CPUs that do not scale well. The D1 chip, a core component of Dojo, features a general-purpose 64-bit CPU with a superscalar core, optimized for machine learning kernels and supporting various data formats. The Dojo system is intended to handle massive datasets from the Tesla fleet, deploying training workloads to continuously improve AI capabilities.

- Optimus: Tesla is actively developing Optimus, a general-purpose, bi-pedal, autonomous humanoid robot. The goal is for Optimus to perform unsafe, repetitive, or boring tasks, requiring advanced software stacks for balance, navigation, perception, and interaction with the physical world. Elon Musk envisions Optimus units handling everything from factory work to household chores, with ambitious production targets of 50,000 units in 2026 and scaling up to 100 million annually.

- Robotaxi/Cybercab: Tesla’s vision for autonomous mobility includes the Robotaxi service, which aims to deploy millions of driverless cars, drastically reducing transportation costs per mile. The Cybercab, a fully autonomous vehicle, was unveiled in October 2024. It is a sleek, two-seater vehicle designed without a steering wheel or pedals, relying entirely on Tesla’s camera-based AI processor. Volume production for Cybercab is scheduled to begin in 2026. Complementing this is the Robovan, a 20-passenger autonomous shuttle envisioned for urban transit and logistics, with an estimated launch around 2028.

The integration of these AI and robotics initiatives, particularly the Dojo supercomputer for training and the FSD chip for inference, demonstrates Tesla’s ambition to create a vertically integrated AI platform. This strategy aims to leverage a “data flywheel” by combining large language models like xAI’s Grok with real-time sensory data from vehicles and robots, potentially allowing Tesla to outpace rivals in both autonomous vehicles and general-purpose AI. This strategic shift positions Tesla beyond traditional automotive manufacturing, betting on its ability to disrupt transportation and labor markets through advanced AI and robotics.

V. Marketing, Branding, and Sales Model

Tesla’s approach to marketing, branding, and sales fundamentally diverges from traditional automotive industry practices, contributing significantly to its distinct market position and growth.

Unique Marketing Approach: Zero Traditional Advertising

One of the most striking aspects of Tesla’s strategy is its near-zero expenditure on traditional paid advertising. Unlike major automotive brands that allocate substantial budgets to marketing campaigns, Tesla has chosen to avoid conventional ads, including social media advertisements. This unconventional approach is rooted in the belief that a truly innovative and excellent product will market itself.

Instead of paid campaigns, Tesla relies on a combination of product excellence, viral moments, the extensive social media reach of its CEO, and a highly engaged customer base. The company invests heavily in research and development, reportedly around $3,000 per vehicle, far exceeding typical industry marketing spends. This investment focuses on developing features like Autopilot and over-the-air updates, which generate significant public discussion and media coverage. Every vehicle sold effectively becomes a “rolling billboard,” and each software update provides new reasons for conversation and media attention. This strategy has allowed Tesla to own the public conversation without paying to enter it, creating buzz through impact rather than frequency.

Role of Elon Musk’s Social Media and Viral PR

Elon Musk serves as Tesla’s de facto chief marketer and brand ambassador. His pervasive social media presence, particularly on X (formerly Twitter), where he commands over 180 million followers, acts as a direct and immediate pipeline to the public. A single tweet from Musk can generate headlines, drive pre-orders, or create widespread discussion, all without any direct promotional cost.

Musk’s hands-on approach to communication involves teasing product updates, breaking company news, and directly responding to customer feedback, often sparking viral moments, whether intentionally or not. This personal branding is a critical component of Tesla’s marketing, generating organic interest through his popularity and the sensational news surrounding him and Tesla’s innovative technology.

A notable example of this viral PR effect is the Cybertruck window fail during its 2019 live unveiling. Despite the “armor glass” shattering when struck by a metal ball, the incident instantly went viral. Far from harming the product’s image, this “demo disaster” paradoxically skyrocketed hype and generated over 200,000 pre-orders, turning a perceived failure into a marketing coup. This event underscores Tesla’s ability to leverage unconventional moments for massive, unpaid media attention. While Musk’s social media activity is a powerful marketing automation tool, it is also a double-edged sword. His unpredictable behavior and controversial tweets have occasionally led to backlash, impacting Tesla’s stock value and even prompting lawsuits from vehicle owners claiming devaluation due to his online antics.

Direct-to-Consumer Sales Model: No Dealerships, Online Ordering Process

Tesla fundamentally deviates from the traditional automotive sales model by selling directly to consumers, bypassing franchised dealerships. This direct sales approach is implemented through an international network of company-owned showrooms and galleries, often located in urban centers or shopping malls, and through a seamless online purchasing experience.

Tesla maintains that this model allows it to:

- Maintain pricing consistency: Eliminating dealer markups and negotiations ensures that the price is the same for all customers, whether online or in-store.

- Control the entire brand experience: From order to delivery and service, Tesla manages the customer journey directly.

- Facilitate product development: Owning the sales channel creates a direct information loop from customers back to manufacturing and vehicle design, accelerating product improvements.

- Enhance customer experience: Customers interact solely with Tesla-employed sales and service staff, avoiding potential conflicts of interest associated with independent dealerships.

The online ordering process is designed for user-friendliness and efficiency. Customers can choose their model, configure it with various options, place an order online with a refundable deposit, and track its progress through their Tesla account. Financing options, including direct Tesla financing, leasing, and trade-ins, are available through the website or in-store. Delivery can be scheduled for pickup at a Tesla delivery center or home delivery.

This direct-to-consumer model has faced legal challenges in several U.S. states where franchise laws prohibit direct manufacturer auto sales, leading to numerous lawsuits from dealership associations. Despite these disputes, Tesla has largely maintained its model, arguing that it is essential to properly explain the advantages of its vehicles to customers without relying on third-party dealerships.

Community Engagement and Referral Programs

Tesla actively fosters a strong, loyal customer base and leverages community engagement as a powerful marketing tool. This strategy turns satisfied customers into brand ambassadors, effectively multiplying outreach efforts without traditional advertising expenses.

A key component of this is Tesla’s innovative referral program. This program incentivizes existing owners to recommend Tesla products, capitalizing on organic word-of-mouth promotion. Each owner is provided with a unique referral link, allowing for digital tracking of new sales attributed to specific referrals. Incentives for participation range from exclusive rewards to discounts on future purchases, strengthening brand loyalty and ensuring continued customer support and advocacy. This approach taps into the natural human desire to share beneficial discoveries, transforming customers into a self-sustaining growth engine.

Tesla also utilizes its social media channels extensively to engage with its audience, disseminate information about its mission, provide product updates, and gather feedback. This active online presence, coupled with the influence of brand ambassadors and social media influencers (including Elon Musk himself), helps cultivate a devoted following and reinforces Tesla’s distinctive brand identity as a leader in sustainability and cutting-edge technology.

VI. Financial Performance and Stock Trends

Tesla’s financial trajectory has been marked by significant growth in revenue and, more recently, consistent profitability, alongside a highly dynamic stock performance.

Annual Revenue History

Tesla’s revenue has experienced exponential growth over the past decade. From a modest $117 million in 2010, annual revenue surged to $96.77 billion in 2023. The most substantial increases occurred in 2021 and 2022, with revenue growing by over $50 billion within just two years. In 2024, Tesla’s revenue reached $97.69 billion.

Table: Tesla Annual Revenue (2018-2024). (Exclusive Tesla Case Study by AdRankLab)

| Year | Annual Revenue (USD Billions) | Source |

| 2018 | $21.46 | AdRankLab Research |

| 2019 | $24.58 | AdRankLab Research |

| 2020 | $31.54 | AdRankLab Research |

| 2021 | $53.82 | AdRankLab Research |

| 2022 | Not Available | AdRankLab Research |

| 2023 | $96.77 | AdRankLab Research |

| 2024 | $97.69 | AdRankLab Research |

Profitability Milestones and Net Income

For many years, Tesla operated at a loss, reflecting the significant investments required for R&D and scaling production. The company reported negative net income for several years, including -$862 million in 2019, -$976 million in 2018, and -$1,962 million in 2017. A critical turning point occurred in 2020 when Tesla achieved its first annual net income of $690 million. This profitability was significantly aided by the sale of regulatory credits, which are discussed further below.

Since 2020, Tesla has maintained strong profitability. Annual net income reached $5.524 billion in 2021, $12.583 billion in 2022 (a 127.79% increase from 2021), and $14.999 billion in 2023 (a 19.2% increase from 2022). However, 2024 saw a decline, with annual net income at $7.13 billion, representing a 52.46% decrease from 2023. The first quarter of 2025 continued this trend, with net income at $409 million, a 71.44% decline year-over-year. This recent decline in profitability reflects broader EV market challenges, increased competition, and price cuts.

Vehicle Production and Delivery Numbers

Tesla’s vehicle production and delivery numbers have grown substantially, albeit with some recent fluctuations.

Table: Tesla Annual Vehicle Production & Deliveries (2014-2024). (Exclusive Tesla Case Study by AdRankLab)

| Year | Production | Deliveries | Source |

| 2014 | 35,000 | 31,655 | AdRankLab Research |

| 2015 | 51,095 | 50,658 | AdRankLab Research |

| 2016 | 83,922 | 76,285 | AdRankLab Research |

| 2017 | 100,757 | 103,181 | AdRankLab Research |

| 2018 | 254,530 | 245,491 | AdRankLab Research |

| 2019 | 365,232 | 367,656 | AdRankLab Research |

| 2020 | 509,737 | 499,535 | AdRankLab Research |

| 2021 | 930,422 | 936,222 | AdRankLab Research |

| 2022 | 1,369,611 | 1,313,581 | AdRankLab Research |

| 2023 | 1,845,985 | 1,808,581 | AdRankLab Research |

| 2024 | 1,773,443 | 1,789,226 | AdRankLab Research |

In 2024, Tesla delivered 1,789,226 vehicles, a slight decrease from the record 1.81 million deliveries in 2023, marking its first annual decline in 12 years. Q1 2025 saw a sharp fall to 336,681 vehicles delivered, the lowest since 2022. The Model 3/Y consistently represent the vast majority of Tesla’s production and sales, accounting for 95% of total deliveries in 2023 and 1,704,093 units in 2024.

Market Capitalization History

Tesla’s market capitalization has shown significant volatility and growth, reflecting investor confidence in its disruptive potential. From $0.18 billion in June 2010 (around its IPO), it grew to $74.21 billion by the end of 2019. The company’s market cap surged dramatically in 2020 and 2021, reaching $764.24 billion by December 2020 and $1.193 trillion by December 2021. Tesla first crossed the $1 trillion market capitalization milestone in October 2021.(Exclusive Tesla Case Study by AdRankLab)

In 2024, Tesla’s market capitalization experienced significant fluctuations. It surged after the U.S. election, doubling from $780 billion on November 4 to an all-time high of $1.54 trillion by December 17, 2024. However, it subsequently plummeted, shedding over $830 billion in value to reach $715 billion by March 7, 2025, and further declining by $130 billion (15.4%) in a single day on March 10, 2025. As of July 14, 2025, its market cap was $1.116 trillion.

Stock Performance and Splits (2020, 2022)

Over the past decade, Tesla’s stock has generated returns of approximately 1,700%, significantly outperforming the S&P 500, which was up around 200% over the same period. However, 2022 saw a decline of over 20% due to rising interest rates and inflation concerns. In 2025, the stock has continued to face headwinds, being down about 22% in the first six months, amidst slowing EV sales growth and increased competition.

Tesla has undertaken two stock splits to make its shares more accessible to employees and individual retail investors, and to improve liquidity.

- 5-for-1 Stock Split (August 2020): This split saw investors receive four additional shares for each one they owned. The stock rallied nearly 60% between the split’s completion and the end of 2020, helping propel Tesla into the S&P 500 index that year.

- 3-for-1 Stock Split (August 2022): Approved and declared on August 5, 2022, this split resulted in stockholders receiving two additional shares for each share held on August 17, 2022. Trading on a split-adjusted basis began on August 25, 2022. The primary reason cited was to offer attractive compensation packages to employees and provide more flexibility in managing their equity.

Stock splits, while not changing the company’s overall valuation or underlying business performance, are believed to enhance accessibility and liquidity by lowering the per-share price.

Impact of Carbon Credits on Profitability

A significant, though often downplayed, component of Tesla’s profitability has been its revenue from the sale of regulatory credits, often referred to as carbon credits or zero-emission vehicle (ZEV) credits. These credits are earned by Tesla for producing and selling zero-emission vehicles, exceeding climate mandates set by government programs in jurisdictions like California and Brussels. Tesla then sells these credits to other automakers who need to comply with these climate-related regulations, particularly those manufacturing internal combustion engine (ICE) vehicles.

These credits represent “pure profit” for Tesla because they are linked to the sale of EVs the company already produces and sells, requiring no additional materials, labor, or energy to generate. While compliance credits constitute less than 3% of Tesla’s total revenue since 2014, they have accounted for more than 32% of the company’s profits over the past decade. Notably, these credits were responsible for Tesla recording its first monthly profit in 2009, a crucial step for meeting the requirements of its $465 million loan from the U.S. Energy Department. In the first nine months of 2024, these credits contributed $1.7 billion, representing 43% of Tesla’s net income during that period. The importance of these regulatory credits has become even more pronounced with the recent dip in Tesla’s vehicle sales in 2024.

This revenue stream highlights a unique financial advantage Tesla holds over traditional automakers. While the automotive and energy product sales generate larger revenue, they come with significant production expenses. The compliance credits, by contrast, are a high-margin revenue source that directly boosts the company’s bottom line without incurring additional operational costs. This mechanism has provided Tesla with a crucial financial cushion, especially during periods of scaling production or market fluctuations, allowing it to reinvest in its core technologies and expansion.

VII. Global Expansion and Gigafactories

Tesla’s global expansion strategy is intrinsically linked to the establishment of its Gigafactories, large-scale manufacturing facilities designed to produce vehicles, batteries, and other energy products. This strategy aims to localize production, reduce costs, and meet regional demand more efficiently.

Overview of Gigafactories and their Capacities

Elon Musk has articulated a vision of building 10-12 Gigafactories worldwide to accelerate the global transition to sustainable energy. As of September 2022, Tesla operated six such facilities: (As Per Tesla Case Study)

- Tesla Fremont Factory (California, USA): The original vehicle manufacturing plant, with an installed capacity of up to 650,000 vehicles per year.

- Gigafactory Nevada (Giga Nevada / Gigafactory 1, USA): Located in Storey County, Nevada, this facility is the first Tesla Gigafactory. It produces lithium-ion battery packs, drivetrain components (including motors), Tesla Powerwall home energy storage devices, and assembles the Tesla Semi. It began mass production of battery cells in January 2017. Tesla’s CEO, Elon Musk, suggested that one hundred factories of this scale would be necessary to transition the world to sustainable energy.

- Gigafactory New York (Giga New York / Gigafactory 3, USA): Focuses on solar energy products, including Solar Roof tiles and solar panels.

- Gigafactory Shanghai (Giga Shanghai / Gigafactory 4, China): The largest manufacturing site among Tesla Gigafactories as of 2022, with a production capacity of over 950,000 vehicles per year. It primarily produces Model 3 and Model Y vehicles and serves as a major export hub.

- Gigafactory Berlin-Brandenburg (Giga Berlin / Gigafactory 5, Germany): Opened in March 2022, this factory manufactures and assembles batteries and Model Y vehicles. It has a production capacity of 500,000 Model Y units per year and is equipped with giant aluminum casting machines. Tesla has applied for a 250-acre expansion plan to double its production capacity.

- Gigafactory Texas (Giga Texas / Gigafactory 2, USA): Official operations began in April 2022, with pre-production of the Model Y taking place in 2021. It has a production capacity of 500,000 Model Y (first phase) and is expected to produce over 1 million vehicles in its second phase, including the Cybertruck and potentially the Semi. Giga Texas utilizes Gigapress technology, capable of producing one EV every 45 seconds.

Impact of Gigafactories on Production and Cost Efficiency

The Gigafactory concept is central to Tesla’s strategy for achieving massive production scale and transforming energy usage globally. By establishing these vertically integrated facilities, Tesla aims to:

- Reduce Costs: Localized production minimizes import tariffs and transportation expenses.

- Increase Production Capacity: Each Gigafactory adds significant manufacturing volume, crucial for meeting growing demand.

- Improve Efficiency: Innovations like Gigacasting and advanced automation (the “machine that builds the machine” philosophy) are designed to streamline the production process, reduce the number of parts, and accelerate output.

- Align with Local Demands: Production facilities in key regions allow Tesla to better cater to local market demands and regulatory requirements.

The decision to build Gigafactories reflects a fundamental belief that revolutionizing the manufacturing process itself is as critical as innovating the product. This capital-intensive approach, while challenging, is designed to create a sustainable competitive advantage by enabling unprecedented scale and cost efficiency in EV production.

China Expansion Strategy and Impact (Gigafactory Shanghai, Megafactory)

China has become a critically important market and production hub for Tesla. Gigafactory Shanghai is not only a major production center for Model 3 and Model Y vehicles but also a significant export hub for other markets.

Tesla’s strategic pivot into energy storage has also taken a monumental leap in China. The company secured a $557 million agreement to build China’s largest battery facility in Shanghai, commissioned by the Chinese government. This “Megafactory” is Tesla’s first battery production facility outside the United States, designed to produce about 10,000 Megapack units per year, significantly enhancing China’s ability to integrate renewable energy sources into its electrical grid. This project, expected to be operational in 2027, fundamentally alters perceptions of Tesla’s core business, highlighting its evolution beyond automotive manufacturing into a comprehensive energy solutions provider.

Despite these successes, Tesla faces mounting pressure in China from increasingly competitive local EV brands like BYD, which offer a wider variety of EVs with more features and lower price points. Tesla has responded by introducing a larger Model Y variant, the “Model Y L,” to appeal to Chinese consumers’ preference for multi-seat electric SUVs and to regain market share. The company has also relied on price cuts and discounts to maintain demand in the highly competitive Chinese market.

Europe Strategy and Impact (Gigafactory Berlin)

Tesla’s first European factory, Gigafactory Berlin-Brandenburg, opened in March 2022 in Grünheide, Germany. The selection of this site was based on its robust infrastructure, excellent connectivity to Berlin via highways and trains, proximity to the Berlin-Brandenburg Airport, and potential for future expansion.

Giga Berlin manufactures and assembles batteries and Model Y vehicles, with plans to feature structural battery packs for increased efficiency. The factory has brought significant economic development to the region, creating thousands of jobs and improving local infrastructure. However, its construction has also generated controversy, including protests related to forest destruction, loss of wildlife habitat, concerns about pollution and groundwater, and issues regarding the project’s approval process. Despite these challenges, the factory represents a key part of Tesla’s strategy to localize production and meet European demand, reducing reliance on imports and minimizing tariffs.

Emerging Markets Expansion (e.g., India entry plans)

Tesla is actively pursuing expansion into emerging markets, exemplified by its recent entry into India. After years of negotiations and anticipation, Tesla officially launched its first showroom in Mumbai in July 2025, featuring two Model Y vehicles. A second showroom in Delhi is planned.

The initial strategy for India involves importing vehicles, primarily the Model Y, from Tesla’s Shanghai factory. High import duties in India (ranging from 70% to 110%) significantly increase the on-road price of Tesla vehicles compared to global markets, posing a challenge for price-sensitive Indian buyers. For instance, the Model Y RWD starts at approximately Rs 60 lakh (about $72,000 USD), nearly double its US starting price.

Tesla’s entry aligns with India’s new EV policy, which offers reduced import duties and incentives for foreign EV manufacturers, following discussions between Prime Minister Narendra Modi and Elon Musk. Customer deliveries are anticipated to begin after September 2025, allowing time for regulatory processes, logistics, and the establishment of after-sales infrastructure. Tesla also plans to install its advanced V4 Superchargers across India to address range anxiety and support long-distance travel. While there are no immediate plans for local manufacturing in India, the success of this retail-first strategy could pave the way for deeper investments. This expansion reflects Tesla’s broader strategy to tap into new growth opportunities as demand in established markets like the US and China shows signs of cooling.

VIII. Controversies and Challenges

Despite its successes, Tesla has faced numerous controversies and challenges, ranging from internal disputes to regulatory scrutiny and labor issues.

Founding Narrative Disputes

As discussed earlier, the narrative surrounding Tesla’s founding has been a source of contention. While Elon Musk is widely associated with Tesla’s origins, the company was founded by Martin Eberhard and Marc Tarpenning in 2003. Musk joined as an investor in 2004 and later became a co-founder through a legal settlement. This dispute highlights the complexities of attributing credit in high-growth, innovative companies and the power of public relations in shaping historical perception.

Autopilot/FSD Safety Concerns, Crashes, and NHTSA Investigations

Tesla’s Autopilot and Full Self-Driving (FSD) systems have been at the center of significant safety concerns and regulatory investigations. The National Highway Traffic Safety Administration (NHTSA) has launched multiple probes into Tesla’s FSD system following reported crashes, including incidents that resulted in fatalities.

In October 2024, NHTSA opened an investigation into 2.4 million Tesla vehicles (Model S, X, 3, Y from 2016-2024, and Cybertruck from 2023-2024) equipped with FSD software. This inquiry followed four reported collisions, including a fatal pedestrian crash in November 2023 involving a 2021 Model Y, where FSD was engaged during reduced roadway visibility conditions (e.g., sun glare, fog, airborne dust) and the system allegedly failed to “react appropriately”.

These incidents highlight a potential weakness in Tesla’s camera-only autonomous driving approach, as adverse weather or environmental conditions can impair camera visibility, a point of criticism from industry experts. Tesla has previously issued large recalls, such as one in December 2023 affecting over two million vehicles, to address Autopilot system issues through software updates. However, NHTSA continues to probe the sufficiency of these updates and whether drivers remain at risk. The U.S. Justice Department has also been investigating Tesla’s FSD and Autopilot systems since 2022. These ongoing investigations underscore the significant regulatory and public scrutiny surrounding the safety and reliability of advanced driver-assistance systems.

Labor Disputes, Unionization Efforts, and Whistleblower Cases

Tesla has faced numerous labor disputes and challenges to unionization efforts across its global operations. With over 140,000 workers as of January 2024, almost none of whom are unionized, Tesla stands as the only major American automaker whose workforce is not represented by a union in the United States.

Efforts by unions like the United Auto Workers (UAW) at the Fremont Factory and Workers United at Gigafactory New York have largely been unsuccessful. Allegations of high injury rates, long hours, and below-industry pay have been reported. Elon Musk has made negative comments regarding trade unions in relation to the company. Tesla has been accused of retaliatory actions against union organizers, such as the firing of Richard Ortiz in 2017, which the National Labor Relations Board (NLRB) initially ruled illegal retaliation. While a 2024 rehearing by the Fifth Circuit Court reversed the NLRB’s order regarding Musk’s tweets as constitutionally protected speech, the NLRB was directed to reconsider Ortiz’s reinstatement. Reports also indicate Tesla hired a public relations firm to monitor employee social media and union organizers from 2017 to 2018.

Beyond unionization, Tesla has faced multiple whistleblower cases and allegations of misconduct:

- Karl Hansen (2018): An ex-security employee at Gigafactory Nevada, Hansen filed a lawsuit alleging retaliation after claiming Tesla installed router equipment to capture employee cell phone communications, was told not to report ties to a Mexican drug cartel, and not to report $37 million in stolen raw materials.

- Cristina Balan (2014 onwards): A former engineer, Balan claimed she was fired in 2014 after raising safety concerns about “hundreds of defects per car” and a design issue potentially affecting braking in the Model S. She has prevailed in a wrongful termination dispute and is pursuing a defamation lawsuit against Tesla.

- Discrimination and Harassment: Tesla has faced multiple lawsuits alleging racial discrimination (e.g., “n-word” usage by supervisors), gender discrimination (e.g., female engineer paid less than male counterparts, pervasive harassment), and sexual/age/sexual orientation discrimination and harassment. Allegations include Tesla ignoring complaints and retaliating with termination.

These disputes underscore persistent challenges in labor relations and corporate governance within Tesla, drawing scrutiny from regulators and legal entities.

Elon Musk’s SEC Battles and Twitter Influence

Elon Musk’s prolific and often controversial use of social media, particularly X (formerly Twitter), has led to multiple clashes with the U.S. Securities and Exchange Commission (SEC).

A prominent case involved Musk’s 2018 tweet stating that “funding had been secured” for potentially taking Tesla private. The SEC sued Musk for securities fraud, characterizing the tweet as false, misleading, and damaging to investors, seeking to bar him from serving as CEO of publicly traded companies. The lawsuit was quickly settled, with a condition that lawyers vet Musk’s future tweets. However, the SEC later concluded that Musk violated this agreement twice by tweeting about Tesla’s solar roof production volumes and its stock price. While a 2019 lawsuit by the SEC to enforce the deal did not go their way, Musk has since faced further SEC scrutiny, including a January 2025 lawsuit for securities violations related to his purchase of Twitter.

Musk’s social media activity is a double-edged sword: while it provides free marketing and direct communication with the public, it also exposes Tesla to significant brand risk and regulatory action. His unpredictable behavior has been cited in lawsuits by Tesla owners claiming devaluation of their vehicles due to his “social media tantrums”. These ongoing battles highlight the unique challenges of a company where the CEO’s personal platform is so deeply intertwined with corporate communications and investor relations.

Quality Control Issues and Recalls

Tesla has experienced a notable number of vehicle recalls, particularly from 2021 to 2024, averaging fifteen recall orders per year. While its first recorded recall was in 2009 for the Roadster, the bulk of issues have emerged more recently. 2022 saw the highest number of recalls in a single year, with 20 orders.

The Model S and Model X have been the most frequently recalled vehicles, with 39 and 38 separate recall orders respectively. The Cybertruck, despite its recent introduction in November 2023, has already been subject to eight recalls within 17 months, addressing issues such as detaching exterior parts, driver inverter problems, and a dislodged accelerator pedal pad.

Many of Tesla’s recalls are addressed through over-the-air (OTA) software updates, particularly for issues related to buggy or defective software. For instance, a 2024 recall affecting over 2.19 million vehicles addressed an incorrect font size for warning lights on the instrument panel via an OTA update. However, 52 of Tesla’s 83 recalls as of March 2025 have required physical service for parts inspection, repair, or replacement.

Common issues reported after OTA software updates include system crashes (e.g., Cybertruck owners post 2024.45.25.5 update), Autopilot/FSD instability (e.g., sudden lane departures, erratic braking), hardware compatibility problems (e.g., updates excluding older hardware, GPS/camera failures), and performance degradation (e.g., lagging screens, battery drain). These challenges underscore the complexities of managing software-defined vehicles and the need for robust quality control processes, both in manufacturing and software deployment.

IX. Competitive Landscape

Tesla operates within an increasingly dynamic and competitive electric vehicle market, facing challenges from both established automotive giants and emerging EV pure-plays, as well as a rising tide of Chinese manufacturers.

Key Competitors in the EV Market

While Tesla has long been the dominant force in the EV sector, its market share is being challenged by a diverse array of competitors:

- Traditional Automakers: Companies like Ford, General Motors (GM), and Volkswagen (VW) have significantly ramped up their EV offerings. Ford’s Mustang Mach-E and F-150 Lightning, GM’s Chevrolet Bolt EV, and Volkswagen’s ID.4 are examples of models directly competing with Tesla’s lineup. These legacy automakers are increasingly gaining ground, with Ford, Chevrolet, Hyundai, and Kia noted for their gains in Q2 2024.

- Pure-play EV Manufacturers: Newer companies such as Rivian and Lucid directly compete with Tesla, particularly in niche segments (e.g., Rivian with electric trucks/SUVs, Lucid with luxury EVs). However, these companies often face significant financial strain and disruption risks due to high costs and intense competition.

- Chinese Rivals: Chinese companies, most notably BYD, have emerged as formidable competitors. BYD has surpassed Tesla in global EV sales, selling 2,785,890 vehicles in 2024 compared to Tesla’s 1,789,226. BYD offers a broader portfolio of EVs, including hybrids, and has dominated the local Chinese EV scene. Other Chinese players like Geely and Wuling are also significant. China leads the global EV transition with over 300 EV options, supported by early adoption and government backing.

Tesla’s Global EV Market Share

Tesla has historically held a dominant position in the global EV market, particularly in the United States. In 2023, Tesla accounted for approximately 12.32% of the global car market based on total global sales. In the U.S., Tesla held about 80% of EV sales in 2022, but this share dropped to 55% in 2023 and further to 48.9% in Q2 2024, marking the first time it fell below 50% since 2017.

Table: Tesla Global EV Sales and Market Share (Selected Years)

| Year | Tesla Deliveries (Units) | Global EV Market Share (Approx.) | Source |

| 2020 | 499,535 | significant growth | AdRankLab Research |

| 2021 | 936,222 | significant growth | AdRankLab Research |

| 2022 | 1,313,581 | significant growth | AdRankLab Research |

| 2023 | 1,808,581 | 12.32% (global car market) | AdRankLab Research |

| 2024 | 1,789,226 | 2nd globally after BYD | AdRankLab Research |

Note: Market share figures can vary based on the definition of “EV market” (BEV only vs. BEV+PHEV) and geographical scope.

Challenges from Traditional Automakers and Chinese Rivals

The competitive landscape presents several challenges for Tesla:

- Increased Competition and Market Share Erosion: Traditional automakers are introducing a wider range of EV models, directly impacting Tesla’s market share. This intensified competition, coupled with adverse economic conditions, has put pressure on Tesla’s stock and thinning margins.

- Price Competition: Chinese rivals like BYD offer more features and lower price points, forcing Tesla to rely on price cuts and discounts to maintain demand, particularly in China. This has contributed to margin compression for Tesla, with Q1 2024 showing its weakest earnings in years.

- Shift to Hybrids: While EV sales growth is slowing globally (e.g., Europe down 4% in 2024), hybrid sales are gaining traction, even in EV-heavy markets like China. Many legacy automakers are pivoting to hybrids as EV sales lag expectations, posing a challenge to pure-EV players like Tesla.

- Regulatory Landscape: Legacy automakers have reportedly fought against EV regulations to protect their gas-powered sales, creating an uneven playing field for pure-play EV manufacturers.

Despite these challenges, Tesla remains profitable on EVs, a distinction from many legacy automakers who are losing money on their EV ventures due to high battery costs and R&D expenses. Tesla’s market leadership, strong brand loyalty, and production scale (1.8 million vehicles in 2023) are significant advantages. Its continued investments in AI, self-driving technology (FSD), and energy storage position it for future growth beyond purely automotive sales.

X. Sustainability Efforts

Tesla’s core mission is “to accelerate the world’s transition to sustainable energy”. This mission underpins its comprehensive sustainability efforts, which extend across its product lifecycle, manufacturing, and energy solutions.

Zero-Emission Goals and Environmental Impact (Production vs. Lifetime Emissions)

Tesla aims to achieve net zero Greenhouse Gas (GHG) emissions across its full product lifecycle, from raw material mining and production through vehicle use and end-of-life recycling. The company emphasizes that its vehicles produce zero tailpipe emissions while driving, a significant advantage over internal combustion engine (ICE) vehicles that emit CO2 and other pollutants.

Studies indicate that, even when accounting for battery production, electric vehicles generally have a lower carbon footprint over their lifetime compared to gasoline-powered cars. Tesla estimates that a single Tesla vehicle, over its average 17-year lifespan in the US, will avoid approximately 35 tons of CO2e globally. However, the environmental benefits are influenced by the energy source used to charge the batteries; carbon savings are substantial if electricity comes from renewables, but diminished if the grid relies heavily on fossil fuels.

Tesla acknowledges that scaling manufacturing into new factories, particularly before they reach full capacity, has inevitably increased short-term emissions. To mitigate this, the company is implementing innovations in material efficiency, supply chain decarbonization, and end-of-life recycling. Tesla also aims to transition its operational electricity load to 100% renewable electricity well before achieving its net zero emissions goal and to match 100% of its Supercharger electricity load annually with renewable electricity.

The development of autonomous vehicles, particularly the Cybercab robotaxi, is also framed as a sustainability effort. Tesla believes that full autonomy and optimized ride efficiency will significantly reduce GHG emissions per mile, potentially avoiding nearly twice as many emissions per mile compared to its Model 3 and Model Y vehicles by maximizing vehicle utilization and rideshare capabilities.

Battery Recycling and Energy Grid Contributions

Tesla addresses the environmental concerns associated with battery production, particularly the mining of critical components like lithium and cobalt, which can involve high water usage, habitat destruction, and energy-intensive extraction processes.

To mitigate these impacts, Tesla has implemented battery recycling programs, designing its batteries to be 100% recyclable and recovering valuable materials such as lithium, nickel, and cobalt for reuse. The company is investing in closed-loop recycling systems to further reduce the need for new mining operations and lower overall environmental impact. Achieving a fully circular economy, however, requires further advancements in recycling technology and greater investment in infrastructure.

Beyond vehicles, Tesla batteries play a crucial role in energy grid stabilization. As the world transitions to intermittent renewable energy sources like solar and wind, there is a growing demand for energy storage solutions. Tesla’s Powerwall and Megapack products contribute to this by storing renewable energy when abundant, helping to balance oversupply and shortage, and facilitating the shift away from CO2-emitting fossil fuels for grid power. Megapacks are specifically designed for utility-scale applications, replacing or augmenting peaker power plants and providing ancillary services to the grid.

Solar Energy and Energy Storage Integration

Tesla’s mission to accelerate the world’s transition to sustainable energy is comprehensively addressed through its integrated approach to solar energy generation and battery storage. In 2016, Tesla became a vertically integrated sustainable energy company with the acquisition of SolarCity, a leading provider of solar power systems in the United States. This acquisition, though controversial at the time due to SolarCity’s liquidity issues, allowed Tesla to combine solar energy generation with its battery storage solutions.

Tesla’s solar offerings include traditional solar panels and the innovative Solar Roof, a product that integrates solar cells directly into roof tiles, offering both energy generation and aesthetic appeal. The company also introduced its own solar inverter in 2021, building on its battery and electric car inverter technology.

The integration of solar energy generation with battery storage products like Powerwall (for homes) and Megapack (for utilities) allows for a holistic sustainable energy ecosystem. This synergy enables customers to produce clean energy, store it, and power their electric vehicles or homes, thereby maximizing the environmental benefit and amplifying the impact of each product. Tesla Supercharger stations are also increasingly being equipped with solar canopies and Megapacks to help power charging, smooth out electric demand, and reduce peak demand surcharges.

XI. Future Outlook and Strategic Vision

Tesla’s future trajectory is defined by an ambitious strategic shift beyond conventional automotive manufacturing, increasingly focusing on autonomy, artificial intelligence, and robotics.

Next-Generation Vehicles

Tesla’s product roadmap includes several next-generation vehicles designed to further its mission of sustainable transportation:

- Low-Cost Model 3/Y (2025): Tesla has confirmed plans to introduce more affordable models in 2025. The first is expected to be a pared-down Model Y, followed by a smaller version of the Model 3 with fewer features, potentially sporting a smaller touchscreen and limited software functionality. These models are intended to utilize a mix of Tesla’s next-generation and existing platforms, allowing for production on current lines and aiming for lower monthly payments to enhance affordability.

- Robotaxi/Cybercab (2026): A key component of Tesla’s future vision is the Robotaxi service, which aims to deploy 1 million driverless cars by 2026, significantly reducing transportation costs. The Cybercab, a purpose-built, two-door coupe designed solely for driverless operation without a steering wheel or pedals, was unveiled in October 2024, with volume production targeted for 2026. This vehicle will rely entirely on Tesla’s camera-based AI processor, optimized for real-time decision-making.

- Robovan (2028): Complementing the Cybercab, the Robovan is envisioned as an autonomous shuttle capable of accommodating up to 20 people, designed for urban transit and logistics. Its estimated travel cost could be as low as 5-10 cents per mile, with a potential launch around 2028.

These next-generation vehicles, particularly the autonomous ones, represent a significant departure from traditional car ownership, aiming to create a future where personal mobility is primarily service-based.

Expansion into AI and Robotics

Tesla’s long-term strategic vision centers on becoming a leader in AI and robotics, leveraging its expertise gained from developing self-driving car technology.

- Optimus: The development of Optimus, a general-purpose, bi-pedal humanoid robot, is a cornerstone of this expansion. Tesla aims for Optimus to perform unsafe, repetitive, or boring tasks, with ambitious production targets of 50,000 units in 2026 and eventually scaling to 100 million annually. This initiative seeks to revolutionize various industries, from manufacturing to household chores, by deploying autonomous, intelligent labor.

- Dojo: The Dojo supercomputer is critical to this AI ambition. Designed specifically for training Tesla’s machine learning models, particularly for Full Self-Driving, Dojo processes massive datasets from the Tesla fleet to continuously improve AI capabilities. This powerful AI training infrastructure is fundamental to achieving the reliability and intelligence required for full autonomy in vehicles and robots.

The vertical integration of AI development, from custom chips (FSD and Dojo chips) to autonomy algorithms and robotics, positions Tesla to create a “data flywheel”. By combining large language models like xAI’s Grok with real-time sensory data from its vast fleet of vehicles and future robots, Tesla aims to accelerate AI learning and potentially outpace rivals in both autonomous vehicles and general-purpose AI.

Elon Musk’s Vision for the Next Decade

Elon Musk’s long-term vision for Tesla extends far beyond electric vehicles. His “Master Plans” outline a future powered by solar energy, run on batteries, and transported by electric vehicles, with a strong emphasis on achieving “extreme scale” to shift humanity away from fossil fuels.

For the next decade, Musk envisions Tesla as primarily an AI-driven robotics company, with autonomous mobility services (Cybercab, Robovan) and humanoid robots (Optimus) becoming core growth drivers. This strategic pivot implies a future where personal car ownership might become obsolete, replaced by on-demand autonomous transport. The company’s focus on building the “machine that builds the machine” and its first-principles approach to solving complex engineering, manufacturing, and operational challenges remain central to this vision.

The successful execution of this ambitious vision hinges on overcoming significant technical and regulatory hurdles, as well as market skepticism. The potential to dominate the autonomous vehicle and robotics markets, which are projected for exponential growth, could justify Tesla’s high valuation, with recurring revenue streams from subscription-based mobility services and new profit centers in industrial and consumer robotics. Tesla’s journey into the next decade is a high-stakes bet on its ability to fundamentally reshape transportation, labor, and daily life through advanced AI and robotics.

XII. Conclusion

Tesla, Inc.’s journey from a nascent electric vehicle startup in 2003 to a global leader in sustainable energy and advanced technology represents a compelling case study in disruptive innovation and strategic evolution. Founded by Martin Eberhard and Marc Tarpenning with a vision to revolutionize the automotive industry, the company gained significant momentum and direction under the leadership of Elon Musk, whose substantial early investments and assertive public persona became inextricably linked with Tesla’s brand identity.

The company’s product evolution, starting with the high-end Roadster as a critical proof-of-concept, systematically expanded into mass-market segments with the highly successful Model S, Model X, Model 3, and Model Y. These vehicles, alongside commercial offerings like the Semi and the futuristic Cybertruck, have demonstrated Tesla’s commitment to diverse market segments. Parallel to its automotive ventures, Tesla’s energy division, bolstered by the acquisition of SolarCity, has grown significantly, offering integrated solar generation and battery storage solutions like Powerwall and Megapack, underscoring its broader mission to accelerate the world’s transition to sustainable energy.

Technological innovation has been a cornerstone of Tesla’s growth. Advancements in battery technology, particularly the development of the 4680 cells, promise enhanced energy density and cost efficiency. Revolutionary manufacturing processes, exemplified by Gigacasting and the “machine that builds the machine” philosophy in its global Gigafactories, aim to achieve unprecedented scale and cost reduction. The continuous development of Autopilot and Full Self-Driving (FSD) systems, coupled with ambitious investments in AI (Dojo supercomputer) and robotics (Optimus, Robotaxi/Cybercab), positions Tesla at the forefront of future technological paradigms.

Tesla’s unique marketing and sales model, characterized by zero traditional advertising, heavy reliance on Elon Musk’s social media presence, and a direct-to-consumer sales approach, has been instrumental in cultivating a fiercely loyal customer base and generating organic, viral attention. This unconventional strategy, supported by robust community engagement and referral programs, has proven highly effective in building brand awareness and driving sales without significant marketing expenditure.

Financially, Tesla has transitioned from years of losses to consistent profitability, although recent quarters have shown a decline in net income amidst increased competition and market pressures. Its revenue has surged exponentially, driven by vehicle deliveries and, notably, substantial income from the sale of regulatory carbon credits. The company’s market capitalization has experienced remarkable growth and volatility, reflecting investor confidence in its long-term disruptive potential, despite recent stock price fluctuations.

Global expansion, particularly through the strategic establishment of Gigafactories in Nevada, Shanghai, Berlin, and Texas, has enabled Tesla to localize production, reduce costs, and penetrate key international markets. While facing intense competition from both legacy automakers and rapidly emerging Chinese EV manufacturers, Tesla maintains a significant, albeit recently challenged, market share.

Despite its successes, Tesla has navigated numerous controversies, including disputes over its founding narrative, ongoing safety concerns and regulatory investigations into its Autopilot and FSD systems, labor disputes and unionization challenges, and Elon Musk’s high-profile clashes with the SEC. Quality control issues and a notable number of vehicle recalls, often addressed through over-the-air software updates, also present continuous operational challenges.

Looking ahead, Tesla’s strategic vision is increasingly centered on a future dominated by AI and robotics. The development of next-generation vehicles like the low-cost Model 3/Y, purpose-built Robotaxis (Cybercab), and autonomous Robovans, alongside the ambitious Optimus humanoid robot project, signals a profound shift in its core business. This trajectory aims to disrupt not only transportation but also labor markets, with Elon Musk envisioning a world where personal car ownership is superseded by autonomous mobility services and intelligent robots perform a wide array of tasks.

In conclusion, Tesla’s journey from 2003 to the present day is a testament to its audacious vision, relentless innovation, and unconventional strategies. Its impact on accelerating the world’s transition to sustainable energy is undeniable, fundamentally reshaping the automotive and energy industries. While the company faces persistent challenges and an increasingly competitive landscape, its continued investment in cutting-edge technology and its ambitious long-term vision position it as a pivotal player in shaping the future of mobility, energy, and artificial intelligence.